What happens when you inherit your parents’ house, and you do not have the means to take on the responsibilities that come with it? Not only does it need repairs, but now you have to take the time to put it on the market and sell to a qualified buyer or find a renter to supplement the costs.

Maybe you are a person who decided to buy a property, become a landlord, and rent the home to tenants. Unfortunately, that does not always work out. Suddenly the tenants are behind in rent, the property needs repairs, and so now you are behind in payments with your lender.

So, what are your options? Well, you do have a lot more than you think. If you are thinking about a short sale or are heading into the foreclosure process, you should know that there is a difference between the two. If you are asking yourself what those differences are and if one is better than the other, we have an excellent breakdown to guide you.

The Foreclosure Definition

To put it simply, foreclosure is when a bank takes back the home (gains possession) because the owner of the property is behind on making payments or has not made payments for a certain length of time.

When Does Foreclosure Start

Banks often vary on the number of days it can take for the entire foreclosure process; however, if you are three months (120 days) behind in your mortgage payment, the bank will more than likely begin the process. Each state has its own regulations and guidelines for lenders to follow to properly file a foreclosure and take possession of the property in question.

Some states are judicial states. In judicial states, the lender must open a court case, give proper notice, and then the process may begin. Some multiple steps and notifications happen along the way in judicial states, so you will be kept apprised often of your foreclosure case status. Some states are nonjudicial states, in which the foreclosure process can move much quicker than the previous style of foreclosure.

How Long Do I Have

Again, as a reminder, foreclosure cases do not typically start until around 120 days past due. After the foreclosure has been completed, you will be expected to vacate the property. The amount of time you have to leave the premises varies from lender to lender and state to state. You will receive an eviction notice that explains to you how long you have to vacate the property. Typically, it is anywhere from 3-30 days.

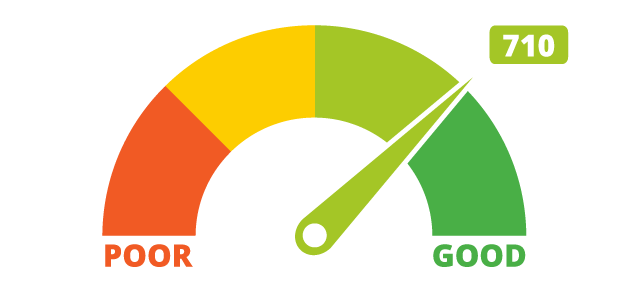

What About My Credit Score

The way a foreclosure affects your credit score has a lot of varied factors behind it. If you had a high-ranking credit score, you would more than likely receive a more significant drop than someone who may have had an average or below-average credit score before the foreclosure. It is not unlikely to see an 85-160 point drop, and in many cases will continue to hurt future borrowing possibilities for up to seven years.

The Short Sale Definition

If you owe more than what your home appraises out to be worth, then you could be in a short sale situation. Depending on the market in which you live, you may owe more money to your lender than what you would be able to sell your home.

Let’s say you get a new job and need to relocate, so you need to sell your home, but you owe too much to do so. The lender may agree to you selling a home for less than what you owe without you bringing money to the table. Essentially, the payoff you would be providing them is less than what you owe.

What About My Credit Score

Short Sales do have a negative effect on your credit score, often dropping anywhere from 120-130 points. The negative impact can stay on your credit report for up to seven years just as in the case of a foreclosure.

However, it will be reported slightly different and could show up in the following possible ways:

- Settled for Less Than the Full Amount Due

- Charge-Off

- Negotiated Settlement

- Settled Debt

What Are the Steps in a Short Sale?

When you seek out a short sale with your bank, the process can take some time. You should prepare for a lot of paperwork and keeping in contact with your lender so the process can be expedited smoothly. Your lender needs to approve a short sale and provide an agreement or payoff letter that is acceptable to them.

To qualify for a short sale with your lender, certain factors need to line up, and you need to be able to provide information attesting to the following situations:

Market Value Dropped

A market analysis of sorts needs to be submitted to the lender. They would like to have sales prices and information on homes in your area that have recently sold. Essentially, they need to know that the market in which you live has dropped and your home is showing signs of depreciation.

Financial Distress Has a Hold Of You

The lender wants to know why you are not able to make your payments in full or on time or why you are struggling to keep the home. They will typically ask you for a financial hardship letter asking you to explain your circumstances. Maybe you inherited the house, lost your job, have health problems or a family member fell ill who supported much of the expenses, no matter the situation, the lender is looking for a viable explanation.

Close to Default

The lender will see you are in financial distress as well if you are behind in payments. It varies from lender to lender. However, most lenders do not begin the foreclosure process for 2-3 months. You should be sure to start a short sale process before that, but if they see you are behind in payments, they know you are in need of a possible short sale.

There are No Assets

Lenders will want to take a look at your financials. The lender will request a copy of your tax returns, any investment plans like a 401K, and any other possible lists of assets you may have. If you have none, then the lender may move forward. However, if you do have a considerable amount of assets, the lender may ask you use your assets instead of proceeding with a short sale.

So, Which is Better? Short Sale or Foreclosure?

From the standpoint of a lender, a short sale is more of an advantageous outcome. With a short sale, they receive more money typically than they would in a foreclosure. Foreclosures cost a lot more money, and in the end, when the property goes up for sale or auction, they may get a lot less than an approved short sale would. In the end, they would rather get some than none.

It’s essential as well to keep in mind that other homes in your area can be affected by the foreclosure. When a property goes into foreclosure, and the process is complete, a sale on a foreclosed home is often for way less than what the property is worth. In turn, values in the neighborhood start to decline overall. In the end, this can lead to more losses for the banks.

When it comes to your outcomes and personal well-being, a short sale is typically the better option between the two. There are a few reasons that this is the case.

If you see the problem coming, you can get ahead of the situation and start talking with your lender early on. Lenders are willing to work with debtors that want to alleviate any future possibilities of late and missed payments. Yes, a lot of lenders will indeed want to see missed payments as proof there is an issue, but it is always worth discussing before missing payments. This could prevent missed payments and late marks on your credit report.

Not always the case, but in many cases, lenders will sue homeowners after a foreclosure for the balance that the homeowner still owes. This is called a deficiency judgment. In addition to your foreclosure ding on your credit report, the deficiency judgment will follow you around for as much as seven years. In some states, judgments will attach to any property you own. If you have more than one or you want to buy one in the future, more than likely you will have to wait more than seven years for that judgment to fall off your report.

Foreclosures can cost a lot of money. If you need representation, legal fees and attorney fees can start to add up. In some states, depending on the process, costs associated with a foreclosure can be upwards of $7,500.00.

Who Would Buy These Homes Then?

It’s widespread knowledge that frequently a foreclosed home requires repairs, which may be one of the reasons it ended up in foreclosure as the owner found themselves without the money to keep up on the property. Because of this, a buyer for a foreclosed home will more than likely need to be a conventional loan buyer. FHA and VA loans will not pass a property that needs multiple repairs during an inspection. FHA and VA loans require work to be done before the purchase of the home so that it is up to their standards. Of course, there are cash buyers as well who can purchase properties in need of repairs.

Conventional loans come with stricter guidelines as far as minimum credit score and how much a buyer needs to put down on a property for purchase. Because of the more stringent guidelines, a lot of people opt not to go with a conventional loan, instead choosing FHA or VA. So, this leaves foreclosed properties unwanted, a stigma that has been around for quite some time.

When it comes to short sales, these homes may be difficult later for future purchases since there was depreciation. More than likely, that reason may be one that lasts a while until a turnaround in the market. The depreciation eliminates the average homebuyer being interested.

Short sales and foreclosures carry around stigmas for quite some time. It may not be a scarlet letter per se, but buyers typically steer clear from these types of properties. More often than not, most buyers will ask, well what is wrong with it? So, they don’t even bother.

So what is the answer? Typically, an investor is the answer for short sale homes and foreclosed homes.

Sell Your House to a Cash Home Buying Company

There are investment companies out there ready to buy your home when you need to sell quickly, whether due to a possible short sale or imminent foreclosure situation. We are a property solutions company in Massachusetts that specializes in purchasing homes just like these. Our team is professional and reliable. We work with you for the best outcome, and you can close quickly with a fair cash offer. As a BBB Accredited company, you know you will be working with someone you can trust.